MSME Udyam Registration 2026

Fast & Paperless Registration by Raj Registry.

Official Partner: Raj Registry

MSME Udyam Registration

Your Key to Government Benefits & Subsidies in 2026

🚀 Unlock the Power of MSME

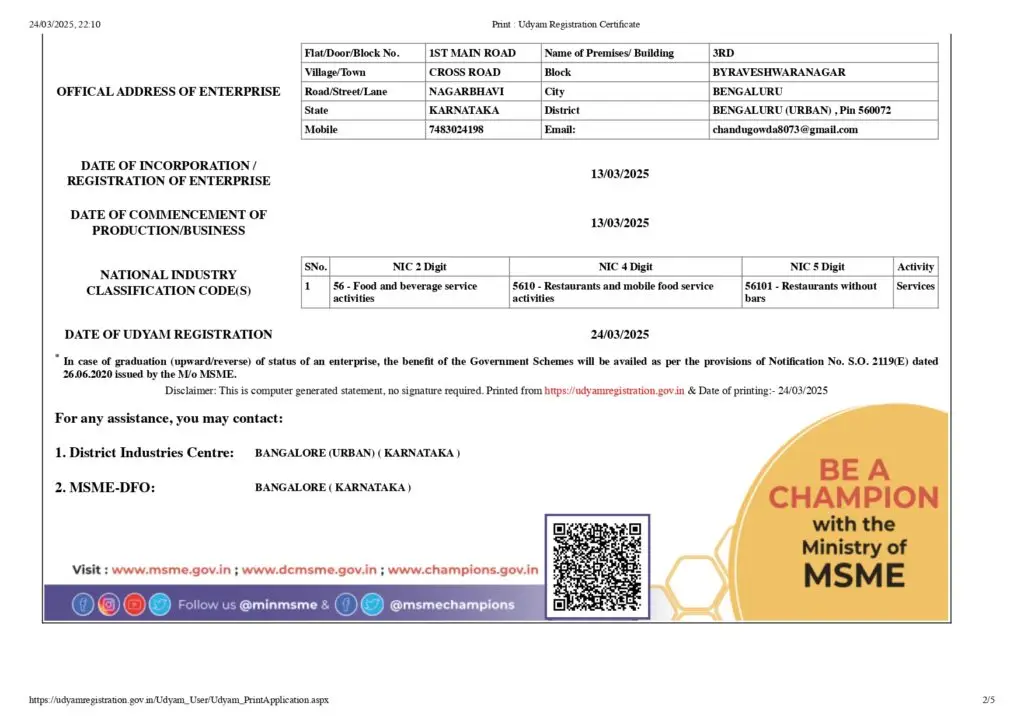

The Udyam Registration is a paperless, self-declaration-based portal for all Micro, Small, and Medium Enterprises. It is now mandatory to have this certificate to claim any government scheme benefits.

| Category | Investment (Plant & Mach.) | Annual Turnover |

|---|---|---|

| Micro | Up to ₹1 Crore | Up to ₹5 Crore |

| Small | Up to ₹10 Crore | Up to ₹50 Crore |

| Medium | Up to ₹50 Crore | Up to ₹250 Crore |

✨ Major Benefits for Udyam Holders:

- Collateral Free Loans: Easier access to credit without mortgaging property.

- Protection Against Delayed Payments: Buyers must pay you within 45 days.

- Interest Rate Subsidy: 1% to 2% lower interest rates on Overdraft/Loans.

- CLCSS Subsidy: Up to 15% subsidy on purchasing new machinery.

🤔 Frequently Asked Questions

1. Is Aadhaar mandatory for Udyam?

Yes. The Aadhaar of the Proprietor, Managing Partner, or Director is mandatory to verify the registration via OTP.

2. Can I have more than one Udyam?

No. An enterprise can only have one Udyam Registration. However, you can add multiple activities (manufacturing and service) under the same number.

3. What is an NIC Code?

National Industrial Classification (NIC) codes identify your specific business activity. Picking the wrong code can lead to your application being rejected.

4. Do I need to upload balance sheets?

No. Udyam is fully integrated with Income Tax and GST portals. Data regarding investment and turnover is fetched automatically.

5. Is it a lifetime certificate?

Yes, Udyam Registration is permanent unless you voluntarily cancel it or your business grows beyond the MSME limits.

6. What is the MSME Samadhaan portal?

If a buyer delays your payment beyond 45 days, Udyam holders can file a complaint on the Samadhaan portal for recovery with interest.

Fast-Track Your MSME Registration

Avoid technical errors and ensure your NIC codes are 100% accurate.

📞 Call Expert: 8971693826Available Mon-Sat | 10:00 AM - 6:00 PM

Apply for MSME Business Loans

Turn your Udyam Registration into working capital

1. Top Government Loan Schemes

PMEGP

Up to ₹50 Lakhs

For new manufacturing units with subsidies up to 35%.

CGTMSE

Up to ₹5 Crores

Collateral-free loans for existing micro & small units.

MUDRA

Up to ₹10 Lakhs

Ideal for shops, traders, and small service providers.

2. The Application Roadmap

Prepare Project Report

A detailed 3-5 year financial forecast is mandatory for bank approval.

JanSamarth Portal Filing

Digital application through the National Credit Portal for faster processing.

Sanction & Disbursement

Bank verification of premises followed by funds transfer to your current account.

📋 Mandatory Documents

- Udyam Registration Certificate

- Last 12 Months Bank Statement

- GST Returns (if applicable) & PAN Card

- Project Report / Business Plan

Confused about Project Reports or Banking Terms?

We help you choose the right bank and handle the documentation to ensure a high approval rate.

📞 Get Loan Assistance: 8971693826Address: 27, MM Rd, New extn, Byatarayanapura, Banashankari 1st Stage, Banashankari, Bengaluru, Karnataka 560026

Ph no: 8971693826